Crypto Market Selloff: Here's Why Bitcoin, Ethereum Price Falling Suddenly

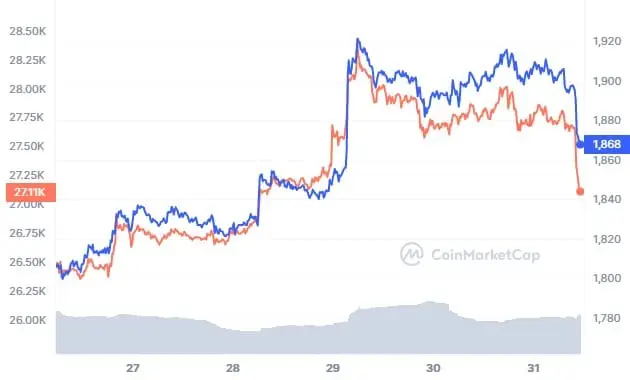

Investors as expected are liquidating their holdings as a result of BTC price closing the month 8% lower for the first time this year. Bitcoin price rallied 85% this year, but the rally started fading in mid-April and even dropped below the key 200-WMA level.

Ethereum, despite showing strength, remains under pressure due to Bitcoin being stuck in a range for weeks and the debt ceiling deal. Whales and institutional investors are bullish on Bitcoin and Ethereum, but a short-term fall is expected as the debt ceiling deal will push US Treasury Dept. to issue T-bill that will pull out US dollar liquidity.

Also Read: Binance Expands Support For Cardano (ADA) And Litecoin (LTC)

Recommended Articles

Here’s Why Bitcoin and Ethereum Price Falling Sharply

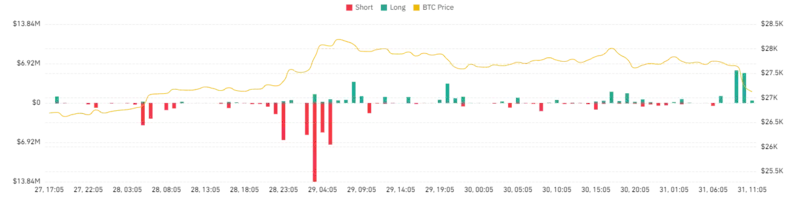

Bitcoin price is currently trading below a key resistance zone after a short-squeeze momentarily move up prices during a low liquidity long weekend with near equal lows below. BTC Open interest is down to 8.5 billion as some longs are being liquidated to fill the CME gap. However, BTC prices can still move higher.

Over $80 million in crypto liquidation was recorded in the last 24 hours, with $25 million and $14 million liquidated in BTC and ETH, respectively. The liquidation is still low as compared to earlier but the macro factors such as Japan and China factory data come in lower.

The hawkish tone from the dovish Bank of Japan central bank led to a Crypto Market fall in Asian hours. Bank of Japan Governor Kazuo Ueda on May 31 warned of tightening as high inflation weighs on the country. The global stock market fell with European and the US market expected to open lower.

BTC price is at an inflection point. If Bitcoin tumbles to 200-WMA, Ethereum will head down below $1800 and other altcoins will follow. BTC price currently trades near $27000 and ETH price is trading at $1850. The Crypto Market action during the US hours will possibly confirm the sentiment in the market.

Also Read: Bitcoin (BTC) To Hit $30K As Early Signs Of Institutional Buying Appears